2024 Allowable Business Expenses Tax Deduction – As a baby sitter who provides child-care services in return for compensation, you can deduct certain expenses of your business. You will need to discern the location of your tax home, which . And you can add approximately 25% of net self-employment income, not exceeding $66,000 in 2023 or $69,000 in 2024 [0] Yes, you can deduct self-employment tax as a business expense. It’s actually .

2024 Allowable Business Expenses Tax Deduction

Source : www.freshbooks.comHow to Make Your Travel Tax Deductible in 2024 | Quicken

Source : www.quicken.comTax Deduction Definition: Standard or Itemized?

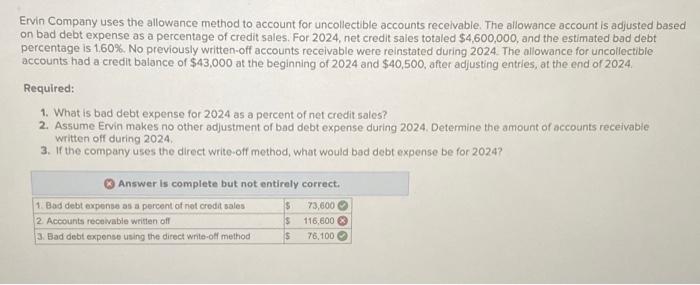

Source : www.investopedia.comSolved Ervin Company uses the allowance method to account | Chegg.com

Source : www.chegg.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

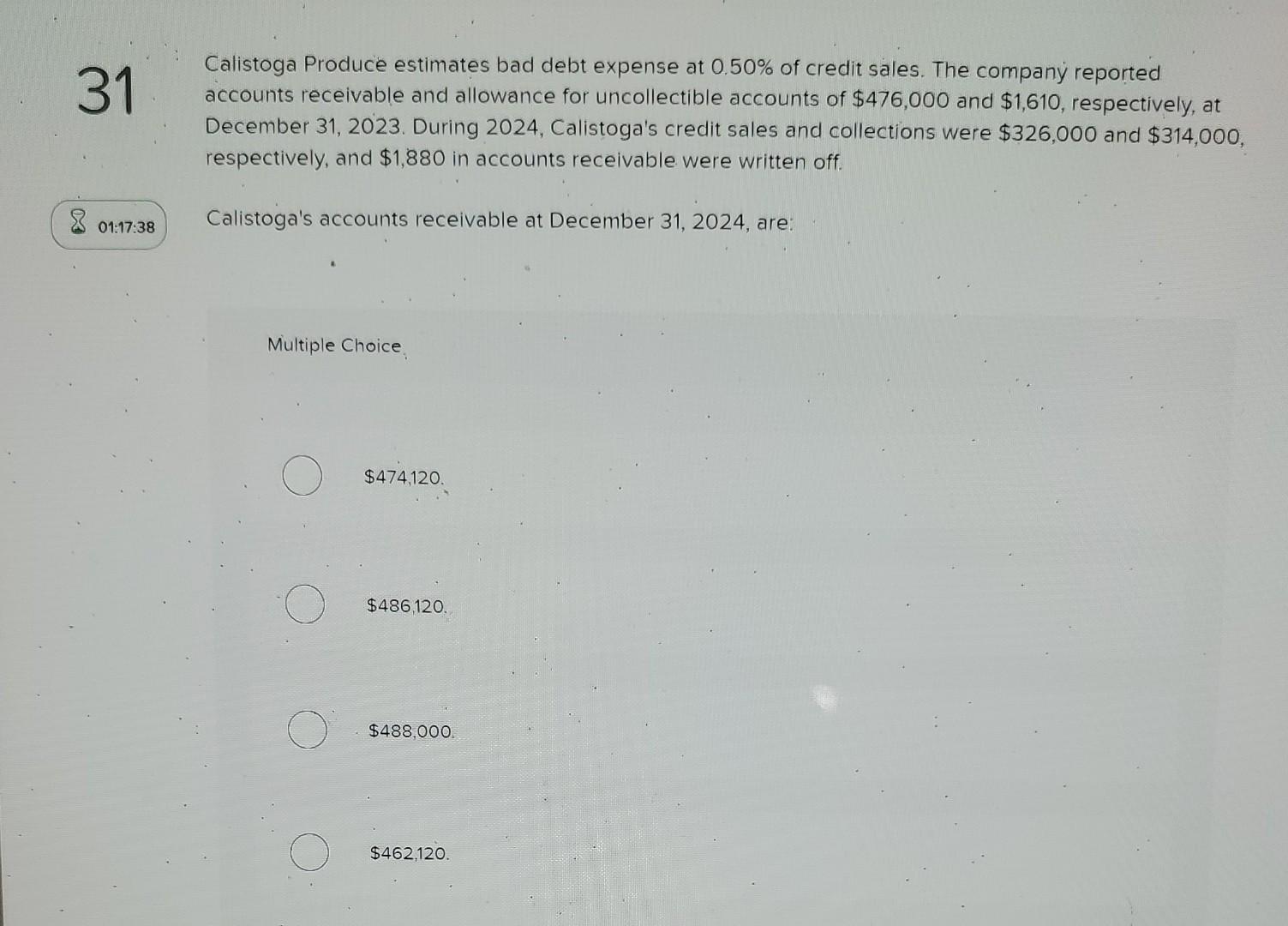

Source : www.forbes.comSolved Calistoga Produce estimates bad debt expense at 0.50

Source : www.chegg.comDeducting Meals as a Business Expense

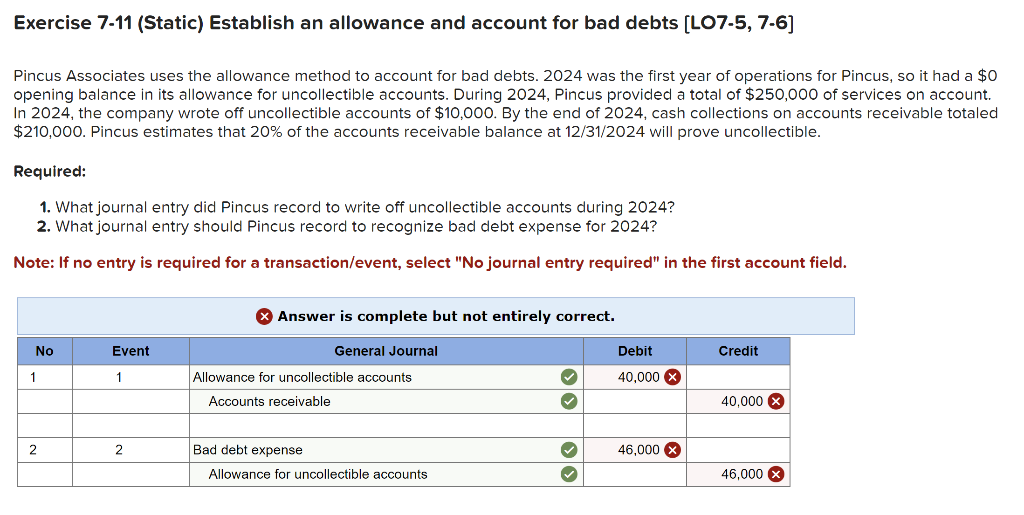

Source : www.thebalancemoney.comSolved Exercise 7 11 (Static) Establish an allowance and | Chegg.com

Source : www.chegg.comAre Medical Expenses Tax Deductible? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com2024 Allowable Business Expenses Tax Deduction 25 Small Business Tax Deductions To Know in 2024: If costs exceed $50,000 in the first year of business, the allowable deduction begins to phase a CPA to determine the appropriate tax treatment for each expenditure. Every business needs customers . Are business start-up costs tax deductible? If you’re starting a new business, you can deduct $5,000 in start-up costs and $5,000 in organizational costs as allowable business expenses in the first .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)