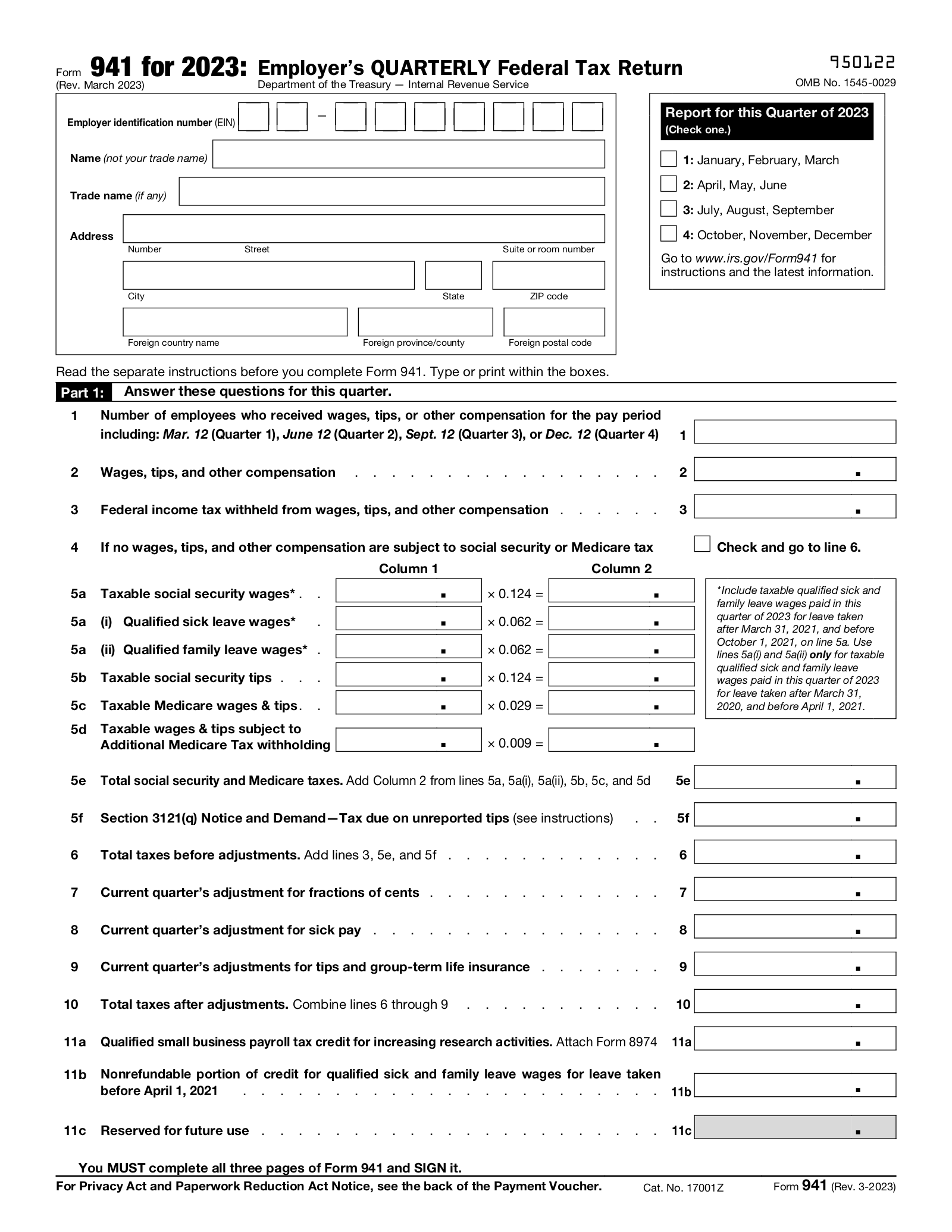

2024 Schedule 2 Form 941 – The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 . If employees who were terminated before the year ended ask for a W-2 prior to the Jan. 31 deadline you and the successor. Complete Schedule D of Form 941 to explain the wage and tax .

2024 Schedule 2 Form 941

Source : form-941-schedule-b.pdffiller.comForm 941: Employer’s Quarterly Federal Tax Return – eForms

Source : eforms.comNavy Federal Pay Dates 2024 Check the Complete Payment Schedule!

Source : www.bscnursing2022.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govWhat is Form 941? | Employer’s Quarterly Federal Tax Return

Source : www.taxbandits.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2024 Payroll Tax & Form 941 Due Dates

Source : www.paylocity.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govForm 940 and Form 941: Big IRS Updates for 2024

Source : blog.boomtax.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2024 Schedule 2 Form 941 2017 2024 Form IRS 941 Schedule B Fill Online, Printable : Use Schedule C for sole proprietorships, Form 1120 for corporate tax returns or Form 1065 for partnerships. When allowed, you can carry over business losses to your Form 1040 from Schedule C or . Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust .

]]>